The taxation of inheritances is a complex issue that touches on economic, historical, cultural, and sentimental aspects. At the heart of the debate is a fundamental question: Is it fair to tax assets that have, in fact, already been subjected to taxation?

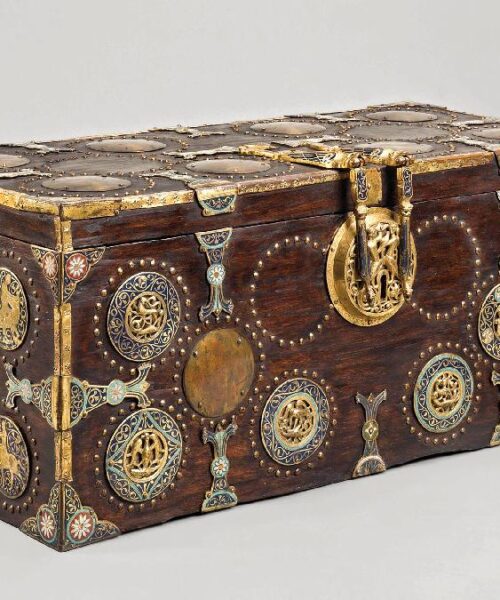

Consider the following situation: a person, over their lifetime, acquires property—a historic villa, a palace, a castle—has paid VAT, property taxes, and every year, has paid the IMU (a municipal property tax in Italy). Within these dwellings are contained art collections, which were also taxed at the time of purchase. Upon the owner’s death, these assets pass to the heirs, who must then pay an inheritance tax.

Here lies the paradox: something that has already been taxed is taxed a second time. And if the heirs cannot afford to pay the steep amount of the inheritance tax, what happens? They are forced to sell.

The consequences of this reality are severe. When it comes to historic villas, palaces, and castles, we are not just talking about buildings, but pieces of our history and cultural heritage. They house frescoes, antique furniture, art collections—priceless testimonies of our past. When these properties are sold, it is very likely that they will be dismantled: art collections are dispersed, structures are renovated, or even demolished. The Italian cultural heritage dissolves, lost forever, or at best, ends up abroad.

Moreover, these buildings are often linked to families that have owned them for generations and have dedicated time, energy, and resources to their maintenance and restoration. For them, losing these properties due to inheritance taxes is not just a financial loss but a blow to the heart, a painful detachment from a part of their family history.

This does not mean that inheritance taxes should be completely abolished. They are an important source of revenue for the state and, if well-calibrated, can contribute to reducing inequalities. However, their application needs to be reviewed, especially when it comes to cultural heritage.

For example, some form of exemption or tax relief should be introduced for properties that have historical or artistic value. This would not only allow families to maintain these properties, but would also encourage their conservation and restoration. Similarly, art collections could be partially or totally exempt from inheritance taxes, provided they remain accessible to the public.

The way inheritance taxes are currently conceived is absurd and harmful. It is time to review this practice, not only to ensure tax fairness but also to preserve our invaluable cultural heritage.